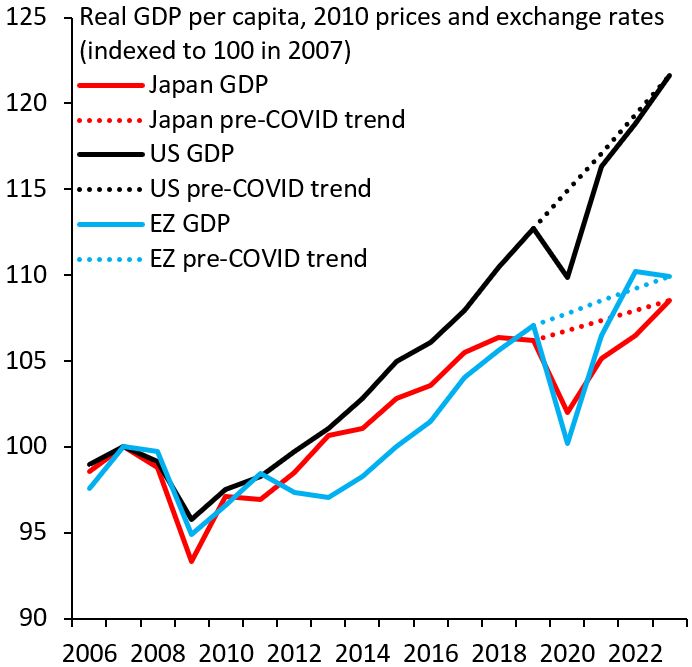

- The U.S. outgrows the eurozone after every adverse shock. It was this way after 2008 and it is happening again post-COVID.

- The underlying reason is a structural deficiency: absence of fiscal union. Fiscal union will require hard compromises on debt and fiscal transfers.

- Without such compromises, the eurozone is heading for Japanification, where high debt is sustainable only thanks to central bank yield caps.

Interesting article. I don’t know enough to judge it, but the comments helps a bit. If you have more articles like this, please post them.

I don’t know how to read this analysis. So, it starts out as a comparative analysis between the US and EU. And that’s where I get lost. Comparing a single country and then failing EU for not having( yet?) a single fiscal policy, because EU isn’t a single country, is just… non applicable (yet).

Also, their quote, about the different levels of gouvernement debt between North and South. while correct, it is also true for some US states. “An equitable fiscal union means countries should enter with similar levels of government debt. That condition is clearly not met in the eurozone, where debt stands at 40% and 60%, respectively, in the Netherlands and Germany, while it lies at 110%, 140%, and 100% in France, Italy, and Spain, respectively”

What I also miss, is the effect of the extreme rise in energy prices, which are (sort of) unique to the European situation.

Unlike the USA, the Euro isn’t a reserve currency, and we can’t print endless money, which is the US way to solve their debts

Their arguments could still be valid though. I’m just unsure how to understand their viewpoints and how to implement them.

We don’t have a fiscal union, we still have debts and they keep rising; more investments( debts?) are needed; energy, tariffs and other trade barriers cripple our import/ export balance etc .

Am no expert here, so hopefully someone can offer more insight and expertise, to shed some light .

Fiscal Union would facilitate Eurobonds according to fiscal union wiki:

" In the European Union, fiscal union has been mooted as a next step forward into deeper European integration but, as of July 2022, remains largely just a proposal. If fiscal union were to happen, national expenditure and tax rates would be set at European Council level. There would be Eurobonds instead of individual national bonds that would finance collective Euro debt."

Add: According to FT article Macron , there are several schemes to implement Eurobonds, the main but not only one, seem to be a fiscal union.

What I also miss, is the effect of the extreme rise in energy prices, which are (sort of) unique to the European situation.

This also falls flat in my eyes. If we are talking about structural differences, the US having moved to be a net energy ressource exporter in a global environment where energy prices increased because of sanctions against major energy exporters like Russia and Iran, that is an easy driver of the economy.

Also the debt analysis just shows that the US financed more of its economy boost with debt. This seems to be the main argument for Europes comparative underperformance, but even if we had a fiscal union, countries like Germany are politically against taking on debt and investment. This problem needs to be resolved politically, probably by Germany hitting a hard recession with its self imposed austerity. It won’t solve with a fiscal union.

Finally looking at figure 2 GDP per Capita evolution

it shows that the 2011 debt crisis drove the first difference, but after that the growth was similar until Trump took office and then it changed big time with Covid and the Russian invasion of Ukraine. This brings us back to your point about energy prices. It also begs the question how much of the US growth is fueled by its military industrial complex on the one hand and how much comes from externalizing production costs by polluting the environment more.