- cross-posted to:

- finance@beehaw.org

- china@sopuli.xyz

- cross-posted to:

- finance@beehaw.org

- china@sopuli.xyz

cross-posted from: https://feddit.org/post/3202701

China’s problem is essentially that it has too much debt.

The main role of debt is to bring forward demand from the future. […] China’s stimulus has kept on increasing since 2008, until it peaked with the end of the pandemic.

Now China risks entering a classic ‘debt trap’ where new loans are taken out to repay existing debt – not to create new demand. In other words, the debt is no longer being used to generate growth. In turn, this risks generating a downward spiral.

[…]

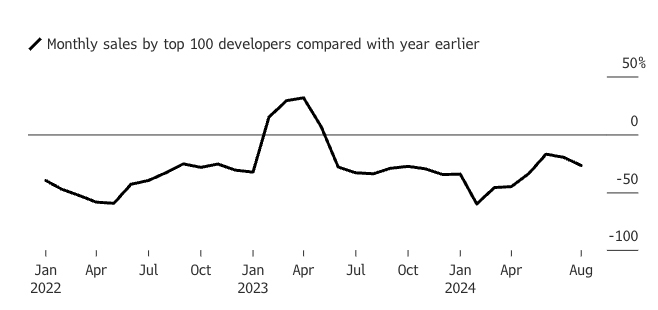

The underlying problem, of course, is China’s massive housing bubble. It was probably the largest ever seen. And it has been bursting for some time, with home sales slumping, as the Bloomberg chart shows.

[…]

China needs to urgently boost [domestic] consumption and downsize manufacturing.

[…]

- Housing is currently unaffordable for most people

- The real estate market is an outsize risk for the economy – it is 29% of GDP, and 70% of China’s urban wealth

- Given China’s ageing population, it seems likely [that housing sales] volume could drop at least another 20% before the market bottoms

- That will mean China will need to import a lot less oil, metals, plastics and everything else connected to the bubble.

You almost made me choke on my $15 Big Mac.

It’s still cheap food. Maybe not to you, but to McDonald’s

Yes, but the “demand” that you are talking about is for cheap on the consumer side, not on the producer side. It may (arguably) still be cheap food on the producer cost side, but the consumer price side has gone insane. The quality definitely is shit.